arizona estate tax exemption 2021

The purpose of the Certificate is to document and establish a basis for state and city tax deductions or exemptions. With the right legal steps a couple can protect up to 2412 million when both spouses have died.

What Is The New Estate Tax Exemption For 2021 Phelps Laclair

Federal estate tax return due nine months after the individuals death though an automatic six-month extension is available if asked for prior to the conclusion of the nine-month period This is required only of individual estates that exceed a gross asset and prior taxable gift value of 1206 million 2412 for couples in 2022.

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

. The estate and gift tax exclusion amounts were increased to 11800000. The exemption amount will rise to 51 million in 2020 71 million in 2021 91 million in 2022 and is scheduled to match the federal amount in 2023 Delaware. All estates in the United States that are worth more than 549 million as of 2017 are required to pay an estate tax.

The estate tax exclusion is 4000000 as of 2021 after the district chose to lower it from 5762400 in 2020. While there is no Arizona inheritance tax law you may or may not be exempt from an inheritance tax based on the federal law. No estate tax or.

Starting in 2022 the exclusion amount will increase annually based on. The 2021 standard deduction is 12550 for single taxpayers or married filing separately. The Arizona State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculator and the dedicated 2021 Arizona State Tax Calculator.

Learn what will happen to property you cant protect with an exemption. 25100 for married couples. The District of Columbia moved in the opposite direction lowering its estate tax exemption from 58 million to 4 million in 2021 but simultaneously dropping its bottom rate from 12 to 112 percent.

On June 16 2021 the governor signed SF 619 which among other tax law changes reduces the inheritance tax rates by twenty percent each year beginning January 1 2021 through December 31 2024 and results in the repeal of the inheritance tax as of January 1 2025. TPT Exemption Certificate - General. Because Arizona conforms to the federal law there is.

Even though Arizona does not have its own estate tax the federal government still imposes its own tax. Arizona State Personal Income Tax Rates and Thresholds in 2022. The amount of the estate tax exemption for 2022 For 2022 the personal federal estate tax exemption amount is 1206 million it was 117 million for 2021.

Federal Estate Tax. Go Paperless Fill Sign Documents Electronically. During the tax year the taxpayer paid more than one-fourth of the cost of keeping this person in an Arizona nursing care institution an Arizona residential care institution or an Arizona assisted living facility.

No estate tax or inheritance tax. The current federal estate tax is currently around 40. The annual exclusion for gift taxes has increased to at 15000.

Although many states impose taxes on lifetime gifts or at-death transfers Arizona does not. Ad Register and Subscribe Now to Work on AZ ADEQ More Fillable Forms. Vermont also continued phasing in an estate exemption increase raising the exemption to 5 million on January 1 compared to 45 million in 2020.

The top estate tax rate is 16 percent exemption threshold. Even though there is no Arizona estate tax the federal estate tax may apply to your estate. Federal Tax Exemption The federal inheritance tax exemption changes from time to time.

The cost must be more than 800. Ad Download Or Email AZ ADEQ More Fillable Forms Register and Subscribe Now. This exemption rate is subject to change due to inflation.

Ad Download Or Email AZ ADEQ More Fillable Forms Register and Subscribe Now. 2019 Arizona Revised Statutes Title 9 - Cities and Towns 9-625 Tax exemption. The federal estate tax exemption is 1170 million for 2021 and increases to 1206 million for 2022.

On June 30 2021 Arizona Governor Doug Ducey signed into law SB. The federal estate tax exemption is 1170 million for 2021 and increases to 1206 million for 2022. Up to 25 cash back The Arizona Homestead Exemption Amount Under the Arizona exemption system homeowners can exempt up to 150000 of equity in their home or other property covered by the states homestead exemption.

This tax is portable for married couples. Arizona offers a standard and itemized deduction for taxpayers. 4 The federal government does not impose an inheritance tax.

The arizona estate tax return was based on the state death tax credit allowed on the federal estate tax return. In August Mayor Muriel Bowser signed the Estate Tax Adjustment Act reducing the exemption from 567 million in 2020 to 4 million for individuals who die on or after January 1 2021. 117 million increasing to 1206 million for deaths that occur in 2022.

1828 enacting comprehensive Arizona individual income tax reform. During the tax year the taxpayer paid more than 800 for either Arizona home health care or. It is to be filled out completely by the purchaser and furnished to the vendor at the time of the sale.

Federal law eliminated the state death tax credit effective January 1 2005. A federal estate tax is in effect as of 2021 but the exemption is significant. Spouses Cannot Double the Homestead Exemption.

In 2020 it set at 11580000. This Certificate is prescribed by the Department of Revenue pursuant to ARS. This means that when someone dies and.

The Arizona estate tax return was based on the state death tax credit allowed on the federal estate tax return.

How To Avoid Estate Taxes With A Trust

Income Tax Clip Art Bing Images Tax Preparation Credit Repair Business Best Credit Repair Companies

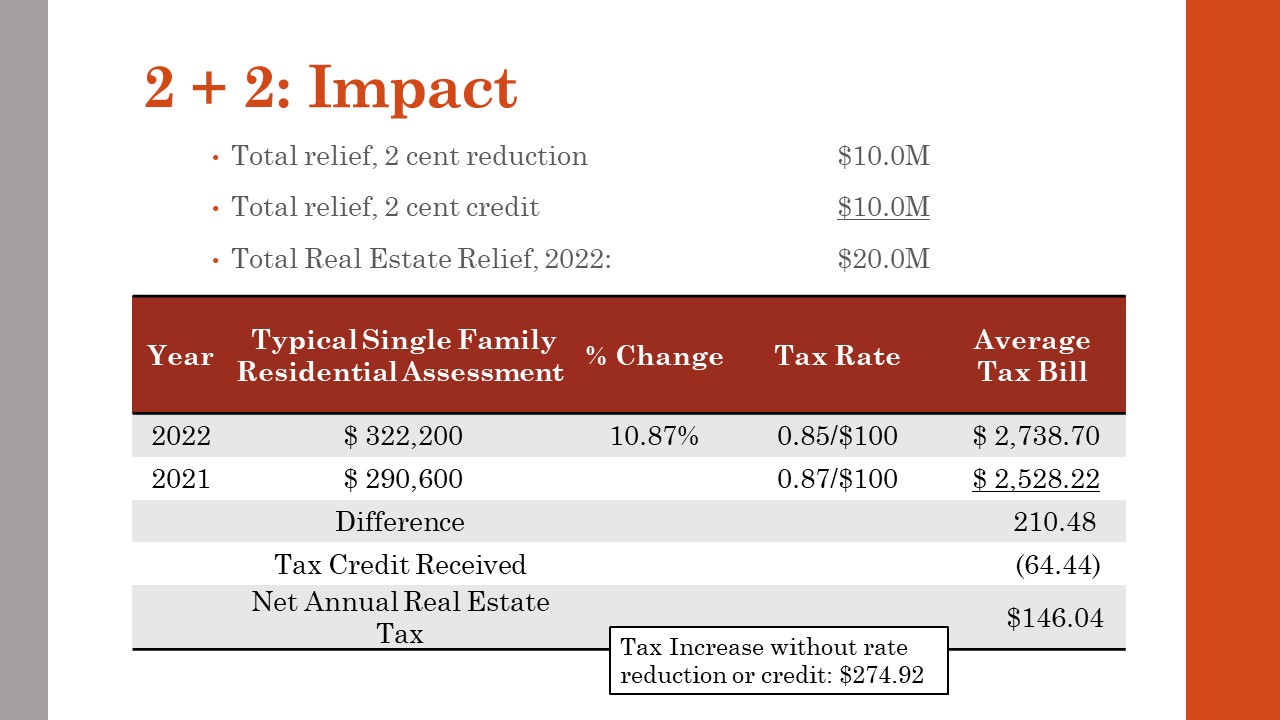

Henrico Approves Ordinance To Offer First Ever Real Estate Tax Credit Henrico County Virginia

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

Property Tax Comparison By State For Cross State Businesses

Estate Tax Definition Who Pays

How To Avoid Estate Taxes With A Trust

A Way To Lock In The Current Estate Tax Exemption To Benefit Your Spouse

Property Tax How To Calculate Local Considerations

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Deducting Property Taxes H R Block

What Is The Future Of The Estate Tax Exemption Phelps Laclair

State Death Tax Hikes Loom Where Not To Die In 2021

Your Guide To Prorated Taxes In A Real Estate Transaction

States With No Estate Tax Or Inheritance Tax Plan Where You Die

What Will Happen When The Gift And Estate Tax Exemption Gets Cut In Half